Buy generic products when ever you can.

Don't buy the premium if you don't need the benefits.

Buy energy efficient cars to save money on gas.

Eat at home more often.

Recycle everything you can get money back for doing it.

Unplug electronics when your not using them.

Use the sun as a light source in the day.

Don't just throw things out have a yard sale.

Eat top ramen it is probably the least expensive meal in the world.

Wear glasses instead of contacts.

Ride your bike more often.

Pay for bills online it will save you the cost of a stamp.

Buy used cloths at thrift stores or yard sales.

If you have a pure bred dog bred it, you can get paid well for selling the puppies.

Save your change even if its just a penny it all adds up in the end.

Make it a habit to use only your bank, thrift or credit union's ATMs. You'll avoid paying surcharge fees to your bank and the other bank. Or consider opening an account with an online bank or brokerage that covers out-of-network ATM fees.

To avoid ATM fees, get cash at grocery stores, where most point-of-sale terminals are free.

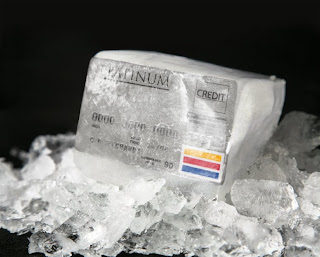

Think before you charge. Unless you're in the habit of paying your credit card bill in full each month, don't use the cards for anything you can eat or wear, and avoid using credit cards to buy wants such as a new stereo or TV. Wait until you have the money to buy it.

If you're knee-deep in credit card debt, get rid of all of your cards but one. Take that one and make it hard to impulse shop with -- freeze it in a bowl of water in your freezer.

Don't take cash out of your credit card. The rate for cash advances is much higher. And there is no grace period -- you start paying interest right away.

Read your monthly credit card statements carefully. Look out for hidden charges, such as credit insurance.

Don't pay for theft insurance on your credit card. If your credit card is stolen, you're liable for only $50 at most.

Avoid credit card fees. Dodge $39-and-growing penalties by not exceeding your credit limit. And send your payments in early -- if you're five minutes late it could cost you $29 or more.

Pay more than the minimum on credit cards. It'll take a very long time and cost you a lot in interest to pay off your balance if you only pay the minimum.

Don't be late on any loan or credit account payment. Credit card companies check their customers' credit reports frequently, looking for any late payments to justify raising the interest rate -- a phenomenon called universal default. In some cases, triggering a universal default can double your credit card's interest rate.

Negotiate better terms -- lower interest and higher limits -- with your credit card issuer, especially if you've had a year of on-time payments.

Consider transferring your balances from high-interest credit cards to low-interest ones. Then make the same payment as before or double the minimum.

If the opportunity exists, work overtime or an extra shift at least once or twice a month.

Participate in a 401(k) or 403(b) plan. Your contributions are made with pretax dollars. You save for the future while reducing today's taxable income.

Set up a tax-advantaged IRA or Roth IRA account to build up your retirement savings.

Save your raise. The next time you get a raise at work or a tax refund, consider directing half to savings. If you're not used to the money, you won't miss it.

Get a home energy audit with your power company every couple of years to find ways to cut costs.

Save on electricity by trading your standard incandescent bulbs for compact fluorescent bulbs. Prices on CFBs have dropped dramatically, and they are more energy-efficient, last for years instead of months, consume little power and generate little heat.

Buy major appliances that sport the Energy Star sticker. That shows the applia nce meets or exceeds standards set by the U.S. Department of Energy and the Environmental Protection Agency.

nce meets or exceeds standards set by the U.S. Department of Energy and the Environmental Protection Agency.

When building a home or replacing a roof, select a roof based more on energy efficiency than on how it looks. Light-colored roofs -- such as white, galvanized metal or cement tile -- do the best job of reflecting the sun, and they cool quickly at night.

on energy efficiency than on how it looks. Light-colored roofs -- such as white, galvanized metal or cement tile -- do the best job of reflecting the sun, and they cool quickly at night.

Every few months, comparison shop to see if you're paying too much for your telecommunications services -- Internet, land line phone and cable or satellite service. Many times, competing companies will offer better deals to new customers. If you find a better deal, contact your telecom providers and negotiate -- or switch.

Cancel all the extra services you don't use, such as call waiting, caller ID, voice mail, call forwarding and three-way calling. For cell phones, block add-ons like text messaging, Web surfing and music downloads if you don't use them.

To save on energy on heating or cooling, buy a programmable thermostat, especially if no one is home most of the day. Set it to turn on a half-hour before anyone arrives home.

Analyze your homeowners or renters insurance to see if there is any coverage that you can do without, and take higher deductibles if you have cash on hand to cover them.

Condo owners need to know what the condo association's insurance policy covers so as not to double-insure.

Some home improvements can reduce the cost of homeowners insurance. Something as simple as installing a fire extinguisher or a deadbolt lock can take a significant bite out of your insurance bill.

Cancel private mortgage insurance, or PMI, once your mortgage reaches an 80 percent loan-to-value ratio.

Make extra mortgage payments, whether monthly, once a year or on some other schedule, to get to 80 percent LTV and cancel PMI more quickly. One way for those on a 26-pay-per-year salary schedule is to make an extra mortgage payment in months where you get three paychecks instead of two.

Fix leaky faucets -- one drip of hot water a second is 20 kilowatts a month.

Be house-wise. Sell the big house or don't buy more house than you need. Get an affordable townhouse or a smaller home if a family member moves out.

Rent out a room in your home if you have more space than you need. If you have grown-up offspring living with you, negotiate with them to pay monthly rent for the privilege.

Landscaping with the right mix of trees and shrubs can lower your energy bills by blocking winter wind and summer sun.

When looking to buy a house or refinance your mortgage, take the time to apply for and compare several mortgage offers from a diverse set of sources: the institution where you do your day-to-day banking, a neighborhood bank, a credit union and an online lender. That way you can have confidence that you got the best terms possible.

When comparing mortgage offers, don't forget to look at closing costs. Fees for things like title insurance and home inspections can vary greatly, even within the same institution. Taking time to compare or negotiate lower fees can save hundreds or even thousands of dollars, greatly reducing the real cost of your loan.

To cut utility bills, add more energy-efficient insulation to your attic with the appropriate R-value, or resistance to heat flow, for your climate and the type of heating in your house.

Switching to an Internet telephone service -- sometimes called Voice over IP, or VoIP -- can save you big, especially if you make a lot of long-distance or international calls. VoIP providers often charge only a flat fee and don't have all the tacked-on taxes and fees that traditional telephone services do.

If you're getting a new mortgage or refinancing in an interest-rate environment where you think rates will fall, apply and then allow your rate to float for a while. Most lenders allow you to wait 30 days or more before locking in the interest rate you'll actually pay, so if you think rates are headed lower, take your time before locking -- you may capture a lower rate. Conversely, if you think rates are heading up, lock immediately. Either way, get your rate in writing. A spoken agreement isn't worth much if your lender decides not to honor it.

Buy a water bottle and a water purifier instead of buying alot of brand name water, is water it all tastes the same.

Take extra ketchup packets from fast food restaurants when you go there [ also remember to take extra napkins]

Reuse jars as drinking glasses.

Use grocery bags as garbage bags.

Carpooling can save a lot of money on gas depending on how much people you have in a vehicle

Cutting coupons can save over 5 dollars per trip to the store and the average family goes to the grocery store 3 times a month that comes out to a total savings of 180$.

Buy in bulk.

Bring leftovers home so that you can eat them as a meal later and save a few bucks.

Don't buy anything from movie theaters they are extremely over priced eat before

the movie

the movieKeep charity recites you can use them as a deduction on taxes.